Unlock the Benefits of Insurance Claim Consultants

- WhiteRockPA

- Jan 26

- 4 min read

When disaster strikes your home or business, dealing with insurance claims can feel overwhelming. The paperwork, the negotiations, and the fine print often leave you confused and frustrated. That’s where insurance claim consultants come in. They are professionals who specialize in helping you navigate the complex world of insurance claims, ensuring you get the compensation you deserve.

In this post, I’ll walk you through the key benefits of working with insurance claim consultants, explain what they do, and share practical tips to make the process smoother. Whether you’re facing property damage, business interruption, or any other insurance issue, understanding how these experts can help is crucial.

Why You Should Consider Insurance Claim Consultants

Insurance claim consultants bring a wealth of knowledge and experience to the table. They understand the ins and outs of insurance policies, claim procedures, and negotiation tactics. Here’s why hiring one can be a game-changer:

Maximize Your Settlement: Consultants know how to assess damages accurately and present your claim in a way that maximizes your payout.

Save Time and Stress: Handling claims on your own can be time-consuming and stressful. Consultants take over the heavy lifting, allowing you to focus on recovery.

Avoid Common Pitfalls: Insurance companies often use complex language and tactics that can confuse claimants. Consultants help you avoid mistakes that could reduce your compensation.

Expert Negotiation: They negotiate with insurance adjusters on your behalf, ensuring your interests are protected.

Support Throughout the Process: From filing the initial claim to final settlement, consultants guide you every step of the way.

If you’re in Dallas and dealing with a claim, working with a local expert who understands the regional insurance landscape can be especially beneficial.

How Insurance Claim Consultants Help Dallas Homeowners and Businesses

Insurance claim consultants tailor their services to meet the unique needs of homeowners and businesses. Here’s how they can assist you specifically:

Damage Assessment

Consultants conduct thorough inspections to document all damages. This includes structural issues, personal property loss, and business equipment damage. They use their expertise to ensure nothing is overlooked.

Claim Preparation

They prepare detailed claim packages with all necessary documentation, photos, and estimates. This helps prevent delays and strengthens your case.

Policy Review

Understanding your insurance policy is critical. Consultants review your coverage to identify all applicable benefits and exclusions, so you know exactly what you’re entitled to.

Communication Management

They handle all communications with the insurance company, reducing your stress and ensuring nothing important is missed.

Dispute Resolution

If your claim is denied or underpaid, consultants can help you appeal or negotiate a fair settlement.

By partnering with a knowledgeable consultant, you increase your chances of a successful claim outcome.

What does an insurance claims specialist do?

An insurance claims specialist plays a vital role in the claims process. Their responsibilities include:

Evaluating Claims: They assess the validity and extent of claims based on policy terms and evidence.

Investigating Losses: Specialists gather facts, inspect damages, and verify information to ensure claims are legitimate.

Processing Paperwork: They manage the documentation required to move claims forward efficiently.

Negotiating Settlements: Specialists work with claimants and insurers to reach fair agreements.

Providing Guidance: They offer advice on claim procedures and help resolve disputes.

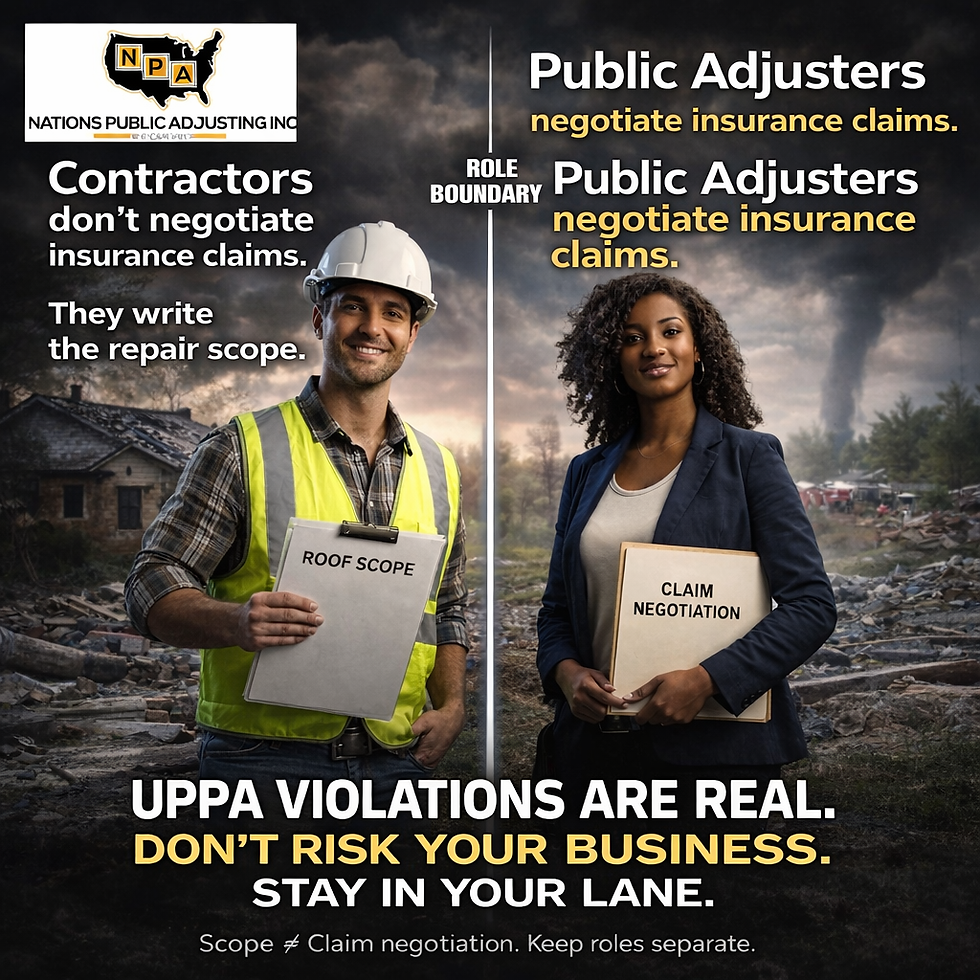

While insurance claims specialists often work for insurance companies, insurance claim consultants work independently for you. This means consultants prioritize your best interests, advocating for the maximum compensation possible.

Practical Tips for Working with Insurance Claim Consultants

If you decide to hire an insurance claim consultant, here are some tips to get the most out of the partnership:

Choose a Local Expert: Consultants familiar with Dallas insurance laws and market conditions can provide better guidance.

Check Credentials: Look for licensed and experienced consultants with positive reviews.

Be Transparent: Share all relevant information and documents honestly to avoid surprises.

Stay Involved: While consultants handle much of the work, stay informed and ask questions.

Understand Fees: Clarify how consultants charge—whether it’s a flat fee, hourly rate, or percentage of the settlement.

By following these steps, you’ll build a strong working relationship that benefits your claim.

Why White Rock Public Adjusting is Your Trusted Partner

Navigating insurance claims can be daunting, but you don’t have to do it alone. White Rock Public Adjusting is dedicated to helping Dallas homeowners and businesses get the full compensation they deserve. With years of experience and a commitment to personalized service, they stand out as trusted insurance claim consultants.

They understand the local market and insurance policies inside and out. Their team works tirelessly to assess damages accurately, prepare strong claims, and negotiate effectively with insurance companies. Choosing White Rock Public Adjusting means choosing peace of mind during a challenging time.

If you want to unlock the benefits of working with insurance claims experts, White Rock Public Adjusting is the partner you can rely on.

By understanding the value of insurance claim consultants and how they operate, you can approach your insurance claim with confidence. Whether it’s property damage, business loss, or any other issue, these professionals help you navigate the process smoothly and secure the compensation you need to rebuild and recover. Don’t hesitate to reach out to a trusted consultant and take control of your insurance claim today.

Comments