How Professional Claims Assistance Simplifies Your Insurance Claims Process

- WhiteRockPA

- Jan 26

- 4 min read

Filing an insurance claim can feel overwhelming. Whether it’s damage to your home or a business loss, the process often involves complex paperwork, strict deadlines, and detailed negotiations. I’ve seen firsthand how professional claims assistance can make this journey smoother and less stressful. When you have the right help, you don’t have to navigate the maze alone. Instead, you get clear guidance, expert advice, and support every step of the way.

In this post, I’ll walk you through how professional claims assistance works, what to expect, and practical tips to ensure you get the compensation you deserve. If you’re dealing with an insurance claim in Dallas, this information can be a game-changer.

Why You Need Professional Claims Assistance

Insurance policies are full of fine print and legal jargon. When disaster strikes, it’s easy to feel lost trying to understand what your policy covers and how to prove your loss. That’s where professional claims assistance comes in. These experts know the ins and outs of insurance policies and claims processes. They help you:

Understand your coverage clearly

Gather and organize necessary documents

Communicate effectively with your insurance company

Avoid common mistakes that can delay or reduce your claim

Maximize your settlement amount

For example, if a storm damages your roof, a professional can help you document the damage properly and estimate repair costs accurately. This ensures your claim reflects the true extent of your loss.

How Professional Claims Assistance Works

When you hire professional claims assistance, you’re essentially partnering with someone who acts as your advocate. Here’s a step-by-step look at how they simplify the process:

Initial Consultation

You discuss your situation and provide details about your claim. The expert reviews your insurance policy and explains your rights and options.

Claim Preparation

They help you collect all necessary evidence, such as photos, repair estimates, and receipts. This step is crucial because incomplete or inaccurate information can hurt your claim.

Filing the Claim

The professional submits your claim to the insurance company, ensuring all forms are filled out correctly and deadlines are met.

Negotiation and Follow-up

Insurance companies may offer settlements that are lower than what you deserve. Your advocate negotiates on your behalf to get a fair payout.

Claim Resolution

Once the claim is settled, the expert reviews the agreement to make sure it’s fair and complete before you accept it.

Throughout this process, you get clear updates and advice, so you’re never left wondering what’s next.

What does an insurance claims specialist do?

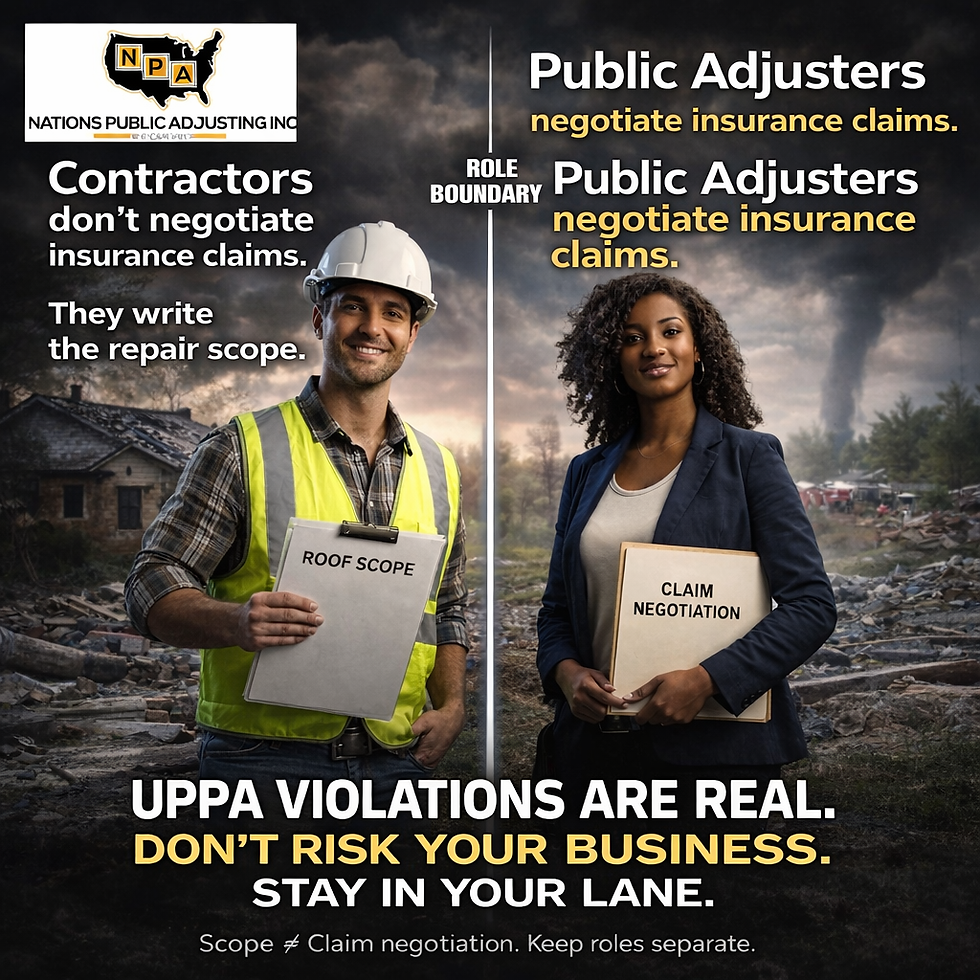

An insurance claims specialist is trained to handle the technical and legal aspects of insurance claims. Their role includes:

Evaluating Damage

They assess the extent of damage or loss to your property or business assets. This might involve site visits and working with contractors or appraisers.

Documenting the Claim

Specialists gather all necessary documentation, including photos, repair estimates, and proof of ownership.

Interpreting Policy Language

Insurance policies can be confusing. Specialists explain what your policy covers and identify any exclusions or limitations.

Communicating with Insurers

They act as your liaison, handling phone calls, emails, and meetings with the insurance company to ensure your claim is processed efficiently.

Negotiating Settlements

Specialists use their knowledge and experience to negotiate a fair settlement, often securing more compensation than policyholders would on their own.

Providing Ongoing Support

They guide you through appeals if your claim is denied or underpaid, helping you understand your options and next steps.

By handling these tasks, insurance claims specialists reduce your stress and increase your chances of a successful claim.

Tips for Working with Professional Claims Assistance

To get the most out of professional claims assistance, keep these tips in mind:

Choose a Local Expert

Working with someone familiar with Dallas insurance laws and local contractors can speed up your claim.

Be Honest and Detailed

Provide complete and accurate information about your loss. This helps your advocate build a strong case.

Keep Records Organized

Save all correspondence, receipts, photos, and estimates in one place. Your claims expert will need these to support your claim.

Ask Questions

Don’t hesitate to ask for explanations or updates. A good professional will keep you informed and involved.

Understand Fees

Clarify how your claims expert charges for their services. Some work on contingency, meaning they get paid only if you receive a settlement.

By following these steps, you’ll create a strong partnership that makes the claims process less daunting.

Why Trusting White Rock Public Adjusting Makes a Difference

When you’re facing the stress of an insurance claim, having a trusted expert by your side is invaluable. White Rock Public Adjusting specializes in helping Dallas homeowners and businesses navigate complex claims. Their team understands local challenges and works tirelessly to ensure you receive the full compensation you deserve.

They bring years of experience, a commitment to transparency, and a personalized approach to every claim. With their help, you can focus on rebuilding your home or business while they handle the paperwork and negotiations.

If you want to learn more about how insurance claims experts can simplify your claims process, reach out to White Rock Public Adjusting today. Their professional claims assistance can turn a stressful situation into a manageable one.

Navigating an insurance claim doesn’t have to be confusing or frustrating. With professional claims assistance, you gain a knowledgeable partner who guides you through every step. From understanding your policy to negotiating a fair settlement, these experts make sure your claim is handled efficiently and effectively. If you’re dealing with property damage or business loss, don’t go it alone. Get the support you need to protect your investment and move forward with confidence.

Comments