Delay. Deny. Defend. The Insurance Claim Tactics Every Texas Homeowner Should Know

- WhiteRockPA

- 3 minutes ago

- 2 min read

When disaster hits your home or business, you expect your insurance company to step in and help you recover.

After all — you’ve paid your premiums faithfully.

But many Texas homeowners quickly discover something troubling:

Insurance companies don’t make money by paying claims quickly. They protect profits by controlling payouts.

And that often comes at your expense.

The Reality Behind Insurance Claims in Texas

Across Dallas and throughout Texas, policyholders are facing:

Long claim delays

Partial payments

Confusing denial letters

Pressure to accept low settlements

Endless requests for documentation

Meanwhile, homes sit damaged. Contractors wait to be paid. Families live in uncertainty.

This isn’t an accident.

It’s a system.

The Insurance Strategy: Delay. Deny. Defend.

1. Delay

Weeks turn into months.

Adjusters rotate. Inspections get rescheduled. Emails go unanswered.

The longer a claim drags out, the more pressure the policyholder feels to settle.

2. Deny

Claims are denied using technical policy language such as:

“Wear and tear”

“Pre-existing damage”

“Exclusion applies”

“Below deductible”

Many valid claims are initially denied — not because they aren’t covered, but because they weren’t properly documented or presented.

3. Defend

When a homeowner pushes back, insurers may:

Bring in engineering reports

Request recorded statements

Hire outside consultants

Reduce scope of damage

Argue pricing

Their goal is simple: minimize payout exposure.

Who Really Pays the Price?

While insurance companies protect their bottom line, the financial burden shifts to:

Homeowners paying out of pocket

Business owners losing income

Contractors absorbing costs

Families displaced from their homes

Your policy was meant to protect you — not create another battle.

Why Insurance Settlements Are Often Too Low

Many initial offers fail to include:

Full material and labor costs

Code upgrade requirements

Hidden water or smoke damage

Overhead and profit

Additional Living Expenses (ALE)

Business interruption losses

Most policyholders don’t realize they have the right to dispute these amounts.

And they don’t have to fight alone.

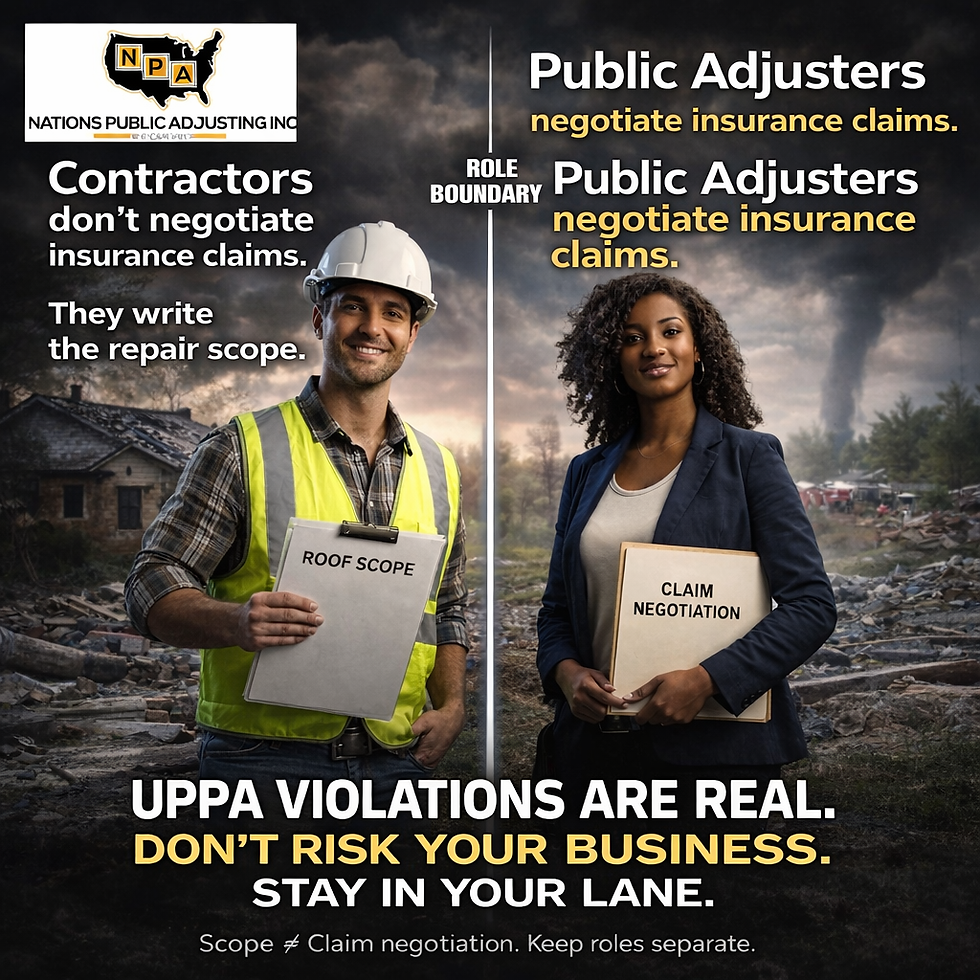

How a Public Adjuster Changes the Outcome

A public adjuster works for you — not the insurance company.

At White Rock Public Adjusting, we:

✔ Conduct detailed loss assessments✔ Prepare accurate, policy-compliant estimates✔ Handle insurer communication✔ Document damages thoroughly✔ Negotiate aggressively for full compensation

We understand Texas policy language. We understand carrier tactics. And we understand how to protect your claim.

Don’t Accept an Underpaid Claim

If your claim has been:

Delayed

Denied

Underpaid

Under-scoped

Stalled

You may be entitled to significantly more.

The earlier you get professional representation, the stronger your position.

Free Claim Review – No Obligation

If you’re unsure whether your insurance company treated you fairly, let us review your claim.

White Rock Public Adjusting, LLC Policy-Driven. Client-Focused.™

📍 Serving homeowners, business owners, and contractors across Texas📞 (214) 770-6032✉️ whiterockpa@whiterockclaims.com🌐 www.whiterockclaims.com

Comments